ev tax credit 2022 infrastructure bill

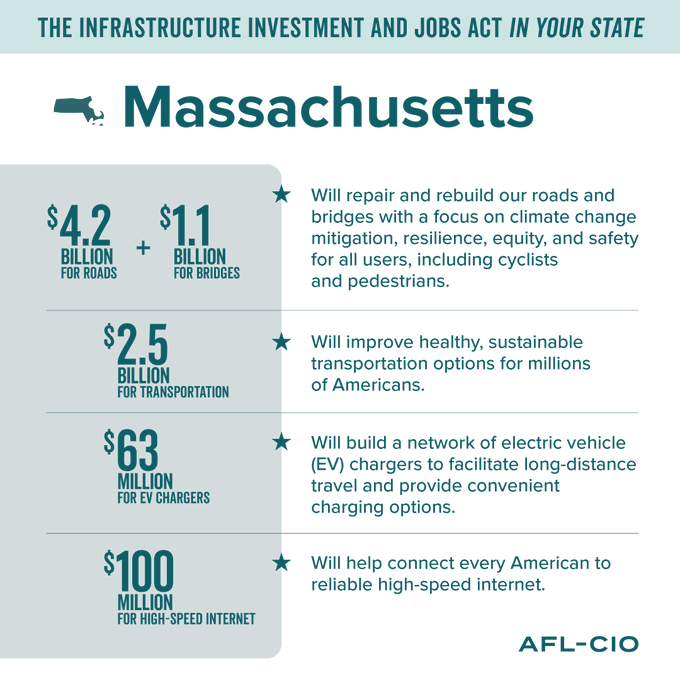

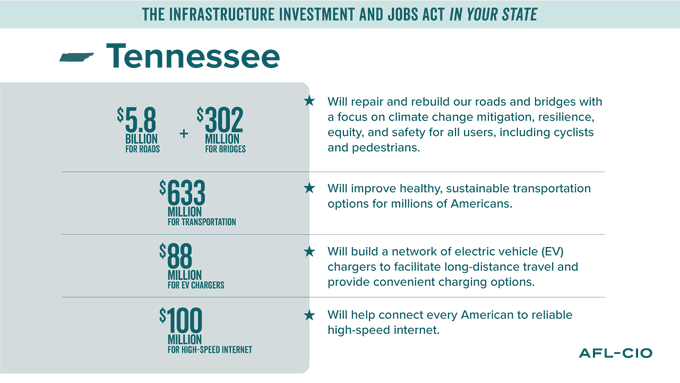

Federal tax credit for EVs jumps from 7500 to 12500 Keep the 7500 incentive for new electric cars for 5 years Add an additional 4500 for EVs assembled in. The infrastructure bill starts with 110 billion to build or expand roads add public EV chargers fill potholes and shore up or replace aging bridges.

Tweaked Infrastructure Plan Keeps Funds For Biden S Ev Chargers Trains Clean Buses

Ev tax credit 2022 infrastructure bill Wednesday July 27 2022 Edit.

. The Democrats in the US Senate have presented a new bill on the tax credit for electric cars. E at a US. Theres also an income limit for taxpayers to receive the credit.

As it stands now the current EV tax credit gives a base amount of 2500 for a four-wheel vehicle propelled by a battery at least a 4 kWh battery and is charged by an external source ie plug-in. Elon Musk elonmusk August 5 2022. Postal Service and federal government to.

This bill retains the amount of 7500 dollars but the upper limit of 200000 electric cars per manufacturer is removed which would make Tesla and GM eligible again. The base credit goes up by 4500 if the vehicle is mad. The law has not yet been passed but at this stage it appears to be a mere formality.

The base minimum credit is increased to 5000 in 2026 Senate version or 4000 in 2022 House version. The proposed EV incentive under Build Back Better includes a current 7500 tax credit to purchase a plug-in electric vehicle as well as 500 if. Although this involves a sprinkle of speculation these are the electric vehicles that will NOT qualify for the new EV tax credit and why.

Theres also funding for local public. A maximum 12500 federal EV tax credit including a bonus for union-made vehicles appears to have survived the negotiation process and is now a likely part of the infrastructure bill. Non-cars vans trucks SUVs need to be under 80000 to be eligible for the credit.

Bloomberg -- New limits for claiming the electric-vehicle tax credit can remain in Democrats tax and spending bill after the Senate parliamentarian determined they comply with the chambers. Factories for EV production and 9 billion for the US. News From Dakar According To Gaussin It Is Entering Its H2 Racing Truck Into The 2022 Desert Crossing Race As A Technology Carrier Dakar Trucks Rally.

08062022 0700 AM EDT. Of those models 70 percent are ineligible for the tax credit when the bill passes. And by 2029 when the additional sourcing requirements go.

Audi all e-tron variants. The bill has proposed to increase the federal tax credit for electric vehicles to 12500 from 7500. Cars need to be under 55000.

Climate adviser McCarthy backs tax credits for electric cars. Another blow to the infrastructure bill is that the Build Back Better bill was put on hold as legislators attempt to lower costs. White House Optimistic EV Credits Will Stay in Reworked Spending Bill.

A large part of the 12500 figure comes from 4500 for EVs made at unionized factories. That bill includes a 30 credit for commercial electric vehicles 35 billion for converting US. EV Tax-Credit Limits Cleared to Stay in Democrats Package Aug 06 2022 by Bloomberg The charging port for a 2024 Chevrolet Silverado EV RST all-electric pickup truck during the 2022 New York International Auto Show NYIAS in New York US on Wednesday April 13 2022.

Plant that operates under a union-negotiated collective bargaining agreement. The Senate has voted to pass the Inflation Reduction Act which includes nearly 400 billion over 10 years in funding for climate and energy related. 250000 for single people.

Electric Vehicle Models That Will NOT Qualify for the New EV Tax Credit in 2023 The much-anticipated Fisker Ocean wont qualify. For this purpose the bill provides a 7500 tax credit to anybody who buys US-made electric vehicles starting 2022 till 2026. Hand-wringing that Democrats signature electric vehicle tax credits battery and minerals sourcing requirements are.

Biden signaled willingness to accept chunks of the legislation. The proposed eligibility requirements for the EV tax credit are simple. 500000 for married couples.

Provided new resources to address this issue in the bipartisan infrastructure bill. EV made with union labor. Todd shared his thoughts on Manchins EV tax credit proposal.

As the bill is currently written a maximum credit of 12500 would go to consumers who purchase a domestically manufactured US. Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet. 7th 2022 208 pm PT.

Its assembled by Magna in Europe.

House Sends Infrastructure Bill With Ev Provisions To Biden Tax Credit For Union Built Evs Delayed Automotive News

The Build Back Better Act The Climate Portion Explained Energysage

Ev Tax Credit Update November 2021 Last Minute Changes Mean More Vehicles Qualify Youtube

Nov 10 Ev Tax Credit Update S Ave 12500 Off Ford F 150 Lightning Or 8000 Off Tesla Model Y 3 Youtube

Senate Deal Should Make It Easier To Buy Electric Vehicles Ap News

Working People Respond To Passage Of Historic Infrastructure Legislation Afl Cio

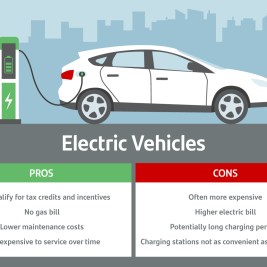

What To Consider Before Buying An Electric Vehicle Santander Consumer Usa

2022 Washington State Ev Trends Electric Car Research

Working People Respond To Passage Of Historic Infrastructure Legislation Afl Cio

Revamped Ev Tax Credit Tesla Toyota Honda Pushing Back Vs Union Made Bonus

Manchin S Electric Car Tax Credits Opposition Imperils Incentive As Prices Rise Bloomberg

2022 Washington State Ev Trends Electric Car Research

Electric Vehicle Incentives In 3 5 Trillion Budget Could Hit Bumps The Washington Post

Even Elon Musk Wouldn T Support Missouri S Ev Tax Credit Bill Show Me Institute

Why 2022 Is The Year To Buy Your First Luxury Electric Car Bloomberg